Visitation rights is a term used when a mom/dad gets the right to see his/her child on a fixed interval basis. Most of the times, visitation rights & monetary support are also intermingled.

This is what is my observation of funded startups in general in India. They raise money — the investors come & “visit” them time to time — Best, you send weekly reports and harness few contacts in their rolodex. Question to ask; are they helping you in building your business?

Entrepreneurial ecosystem is in it’s infancy in India — resources are not available, event platforms are sparse, celebarations of success barely exist, peer support is meagre, etc. What we need is hand holding, support, building of business and not just money & remote supervision. Of course, money helps to reduce the friction of starting up — but it’s not the only lubricant required.

Comes Morpheus Venture Partners, a Business Accelarator out of India which I joined as a Partner few months ago. Our vision is to reduce the friction of starting up & provide end-to-end support ranging from building your pricing model to finding the right technology stack for a startup. Of course, we want to provide money too, which we are working on.

Less than 24 hours ago we announced our latest batch of 10 startups — each one of them is envisioning to bring a change using their model for people of India. Being a deep technologist, I always thought that the next big thing can only come out of technology and maybe the next Google is going to be from India. That’s very much a possibility but it’s hard to sustain a viable business when less than 40 million users are online (a large % of which use the net only once a week!).

So who are these guys? What’s the new batch of 10 upto? I totally resonate the way Nandini Hirianniah (Founding Partner at MVP) summarized these 10 heavy-hitters:

Adscoot’s Suyash, stands for hours in the major junctions at mumbai to learn traffic patterns and measure footfalls!

EasySquareFeet’s Ashu & Snehesh are the most positive people i’ve seen! I can see their smiles through the phone when i talk to them (serious!)

Viv & Hari of InterviewStreet are two rockstar techies who are consciously & fast learning other skills to take their product to market. They have the passion & drive to make things work!

Shashank & Abhinav started on Naabo right out of college – the freshness in approach & the passion they bring with them is infectious.

Arjun of Picsean is an engineer, but his passion towards photography is amazing! He’s a good friend & i’ve seen his focus and smart work in his past ventures. His attitude to learn is commendable!

Robin of ReachTax is a star CA, but i love his humility and the motivational skill he has to make his entire team perform month after month!

Pankaj & Gaurav quit their fancy paying jobs to work on Retail Vector. Focus, quick work and frugality of life is what they are committed towards as they scale this venture!

The first thing that stood out when i met Abheek first was such an young guy and such maturity & humility. (Often age and humility dont go too well). This guy was 7 years old when he started putting Lego pieces into perfect ensemble & several years later, he’s using them at RobotsAlive!

I loved their designs and the quality of tees – Rahul & Mohit of Scopial have their focus completely on “Quality” “Design” “Niche”! They sell tees one could die for! Check a sample out here

I read about these guys in a print article & the next time we were in Mumbai, we met Jayesh & Karthik of VeriCAR. Two guys crazily passionate about automobiles!

Thanks to the startups for choosing us their ‘limited co-founders’, I’m sure this association is going to go a long way. Now, for the next 4 months, we spend dozens of hours every week with the founders poring over the details of their business and helping iron out every possible kink.

Agreed, we can’t change how users would percieve their offerings and how big they could possibly get — Yes, we can influence the positive outcome to a great extent.

Update: Added VeriCAR’s sound bytes from Nandini’s post

As a Founder, CEO, whatever of the startup — one thing you would be doing in your journey would be Selling. Selling to customers, employees, partners, investors, family members, competitors. And selling 24×7. Pestering. Following up. Closing. The code you write, the product you build, the team you hire is given. People worry about the actual tangible later, but you need to sell it first. Sell the concept. Sell the features. Sell your vision.

As a Founder, CEO, whatever of the startup — one thing you would be doing in your journey would be Selling. Selling to customers, employees, partners, investors, family members, competitors. And selling 24×7. Pestering. Following up. Closing. The code you write, the product you build, the team you hire is given. People worry about the actual tangible later, but you need to sell it first. Sell the concept. Sell the features. Sell your vision. As the year 2009 comes to close, it’s time to reflect on what has been done and also the time to dream what the world is going to achieve. Personally, I came back to India after a gap of almost a decade and have been playing catchup; trying to understand the changing business here with a perspective. Dreaming of things what could be achieved here, I thought I would throw some predictions for 2010 in the desi kitchen bag. Here is my list:

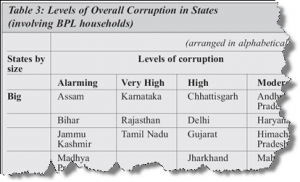

As the year 2009 comes to close, it’s time to reflect on what has been done and also the time to dream what the world is going to achieve. Personally, I came back to India after a gap of almost a decade and have been playing catchup; trying to understand the changing business here with a perspective. Dreaming of things what could be achieved here, I thought I would throw some predictions for 2010 in the desi kitchen bag. Here is my list: Do we think that the advancement in technology, media, innovation are automatically going to fix the larger issues of corruption which touch our daily lives in an infamous way? Or we simply ignore this like we ignore the garbage outside our own homes?

Do we think that the advancement in technology, media, innovation are automatically going to fix the larger issues of corruption which touch our daily lives in an infamous way? Or we simply ignore this like we ignore the garbage outside our own homes? When Markets become conversation, the participation benefits the parties involved, viz. (a) The Intent Owner. This is the person who has the money, spends time and effort. In a non-generic sense, this person is the buyer/purchaser/decision-maker of goods/services/products (b) The “Goods” Owner. A person or an entity who has something of interest for which people will spend time, money and effort.

When Markets become conversation, the participation benefits the parties involved, viz. (a) The Intent Owner. This is the person who has the money, spends time and effort. In a non-generic sense, this person is the buyer/purchaser/decision-maker of goods/services/products (b) The “Goods” Owner. A person or an entity who has something of interest for which people will spend time, money and effort.